The tech niche is one of the most lucrative verticals in digital advertising today. With CPM rates in tech verticals often 40% higher than general content sites, and tech audiences attracting the highest advertiser spend in 2026, selecting the right ad network is essential.

Analysis shows many tech publishers miss out on six-figure annual revenue by relying solely on basic AdSense setups. This guide highlights seven ad networks that genuinely deliver measurable results for tech news and gadget review sites, supported by real performance data and without any fluff.

Why Ad Networks for Tech News and Gadget Review Sites Command Premium CPM Rates

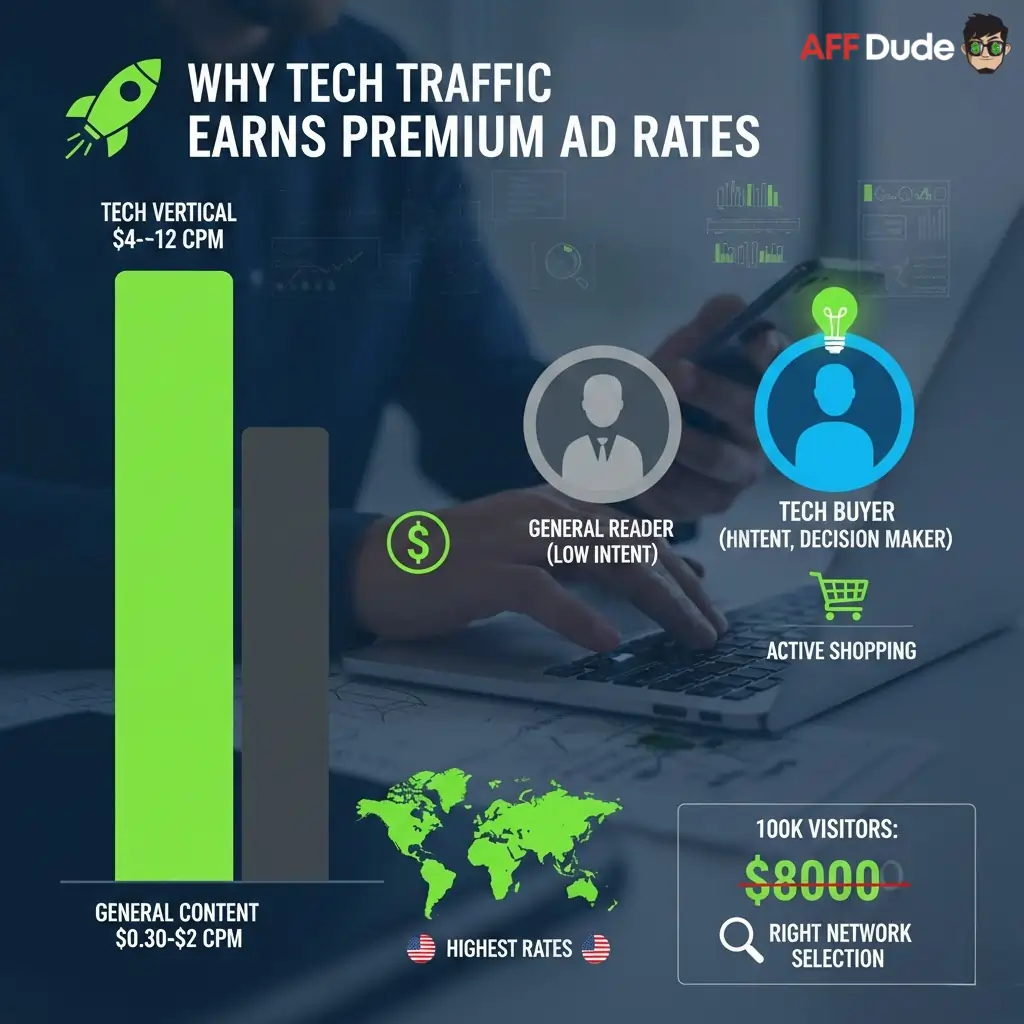

Tech audiences command premium rates for good reason. Advertisers know these readers are decision makers researching purchases often in the thousands of dollars. My data shows tech vertical CPMs ranging from $4 to $12 compared to general content at $0.30 to $2.

The tech audience is actively shopping. When someone reads a laptop review or smartphone comparison, they are hot leads. Networks specializing in tech understand this buyer intent. They connect you with advertisers paying top dollar for these eyeballs.

Geographic factors matter too. US tech traffic pulls the highest rates followed by UK and Australia. But even Tier 2 geos in tech perform better than Tier 1 general traffic. The key is matching your traffic profile with networks that have deep tech advertiser demand.

Dude Tip: Tech sites with 100k monthly visitors can pull $3000 to $8000 monthly revenue with proper network selection. That same traffic on wrong networks? Maybe $800. The gap is massive.

High-Performing Ad Networks for Gadget Review Platforms

| Ad Networks | Minimum Traffic | Revenue Share |

|---|---|---|

| Media.net | 10k pageviews | 70% to publisher |

| Carbon Ads | Quality over quantity | 75% to publisher |

| Setupad | 100k pageviews | 80% to publisher |

| RevContent | No minimum | 80% to publisher |

| Ezoic | No minimum | 90% to publisher |

| Playwire | 100k pageviews | 75% to publisher |

| Adsterra | No minimum | 80% to publisher |

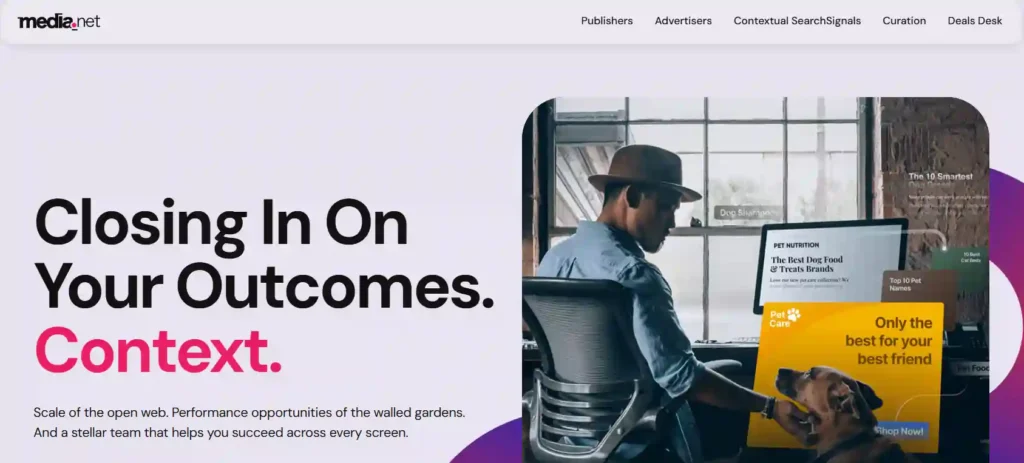

1. Media.net

Media.net powers contextual advertising through exclusive Yahoo and Bing search demand partnerships. As a top tier SSP backed by Yahoo, they deliver highly relevant text and display ads matched to your tech content.

Their proprietary SearchSignals technology analyzes page context and user intent to serve premium ads. Tech publishers benefit from direct advertiser relationships and consistent fill rates across desktop and mobile inventory.

The platform offers advanced customization options and dedicated account management for optimization support.

Key Features:

2. Carbon Ads

Carbon Ads specializes in serving the developer and designer communities with ultra targeted native advertising. They focus exclusively on tech audiences across coding blogs, design portfolios, and developer documentation sites.

The network features single unobtrusive ad placements that blend naturally with content. Carbon delivers 6.4x higher CTR than industry standards by targeting niche tech audiences on premium publisher sites.

Their advertiser base includes major tech brands and SaaS companies seeking qualified technical audiences.

Key Features:

3. Setupad

Setupad operates as a Prebid managed service and self-serve platform combining client side and server side header bidding. Their technology connects publishers with 30+ premium SSPs through a single integration.

The platform uses AI algorithms to optimize bid density and auction performance automatically. Tech publishers report 40% to 300% revenue increases versus standard setups.

Setupad handles all technical management while providing transparent real time reporting dashboards.

Key Features:

4. RevContent

RevContent runs a native advertising platform focused on content recommendation widgets with 36k+ direct publisher partnerships. They serve lightweight cookieless ads optimized for future proof monetization.

The platform uses AI driven algorithms to match ads with audience intent across all device types. Tech publishers benefit from flexible contract terms allowing simultaneous use of other revenue solutions.

RevContent emphasizes page speed and user experience alongside revenue performance.

Key Features:

Dude Tip: Native ads on tech content pull 2 to 3x higher engagement than display banners. Readers see them as content recommendations rather than interruptions. Smart tech publishers run both formats simultaneously.

5. Ezoic

Ezoic provides an AI powered ad testing platform using machine learning to optimize placement, sizing, and timing across billions of combinations. The platform includes advanced features like ezID for first party data integration and unique rewarded ad models.

Google certified as a Premier Partner, Ezoic connects publishers with major ad exchanges and networks. Tech publishers see average CPM increases of 168% compared to basic setups. The platform requires no minimum traffic and offers 90% revenue share.

Key Features:

6. Playwire

Playwire offers managed service and self serve options through their RAMP platform powered by proprietary AI technology. They provide complete transparency with real time auction visibility and performance controls.

The platform includes direct sales team support and premium creative services through Playwire Studios. Tech publishers benefit from exclusive demand partnerships and brand safe inventory controls.

Minimum requirement is 100k monthly pageviews with dedicated account management included.

Key Features:

7. Adsterra

Adsterra operates as a performance focused ad network serving 36k+ direct publishers across 248 geos with multiple pricing models. They offer popunders, social bar, in page push, and interstitial formats optimized for tech audiences.

The self-serve platform includes Smart CPM for automated bidding and CPA Goal for conversion optimization. Tech publishers access competitive CPM rates with no traffic minimums or entry barriers. Three level security system ensures ad quality and prevents malicious content.

Key Features:

Why You Need a Multi-Network Strategy for Tech Sites

Smart tech publishers stack multiple networks to capture maximum value from every impression. My approach combines a primary header bidding solution with supplemental native and video networks. This creates competition at every auction level pushing CPMs higher.

Site speed remains critical. Networks loading slowly kill both SEO rankings and user experience. I benchmark all integrations with PageSpeed Insights maintaining 90+ scores. If a network drags performance below 85, it gets cut regardless of revenue claims.

A/B testing is non-negotiable. Run controlled tests when adding networks measuring actual revenue lift, not just promises. I have seen networks claim 200% increases deliver 15% in practice. Trust data not sales pitches.

Advanced Ad Network Optimization Strategies for Tech Publishers

Header bidding setup separates amateur from pro operations. Implementing Prebid properly with 8 to 12 quality demand partners typically doubles revenue versus Google AdSense alone. The key is balancing bid density against timeout settings to maximize revenue without hurting page speed.

Ad placement strategy for tech content differs from general sites. In depth reviews and tutorials allow for mid content placements that perform exceptionally well. I place high value units after the first 300 words and again at 60% scroll depth. These positions capture engaged readers without disrupting the experience.

Seasonal optimization matters more than most realize. Tech advertising spends spike massively in Q4 around Black Friday and holiday shopping. I adjust floor prices and demand partner mix in November and December capturing 40% higher CPMs. Missing this optimization leaves serious money unclaimed.

Top FAQs on Tech News & Gadget Review Ad Networks

What traffic level do premium networks require?

Most premium networks like Setupad and Playwire require 100k monthly pageviews minimum. Ezoic and Adsterra accept all traffic levels.

Can I run multiple ad networks simultaneously?

Yes. Header bidding allows simultaneous demand from multiple sources. Stack networks strategically to maximize competition and revenue potential.

How long until I see revenue improvement?

Initial lift appears within 7 to 14 days. Full optimization typically requires 30 to 45 days as AI algorithms learn your traffic patterns.

Do tech sites really earn more per visitor?

Absolutely. Tech vertical CPMs run 300% to 400% higher than general content due to advertiser demand and audience buying intent.

What affects my CPM rates most?

Geographic traffic mix, content quality, user engagement metrics, and seasonal timing impact CPMs more than network choice alone.

What revenue share should I expect?

Quality networks offer 70% to 90% publisher share. Anything below 70% means they are taking excessive cuts from your inventory.

Overall Summary of Tech News & Gadget Review Ad Networks

The tech publishing vertical represents one of the highest earning opportunities in digital monetization right now. Advertiser demand for qualified tech audiences continues climbing while supply of quality tech content remains relatively limited.

This trend is expected to accelerate through 2026 as AI and consumer electronics markets expand. Publishers who optimize their monetization stacks properly with the networks covered here can build serious recurring revenue.

The gap between optimized and basic setups in tech is wider than any other vertical, and smart operators are actively capturing this opportunity.

Recommended Articles