Mobile app monetization has shifted fast, but most advice still focuses on games while non-gaming apps quietly drive serious revenue.

If you’re building productivity, social, lifestyle, or utility apps, using ad networks built for gamers is like forcing a square peg into a round hole — your fill rates, eCPMs, and UX all suffer.

After testing multiple SDKs, mediation setups, and billions of impressions across non-gaming apps, this guide breaks down the 10 best Ad Networks for Mobile App Developers Non-Gaming. The goal is simple: stable earnings, clean integrations, and ads your users actually tolerate.

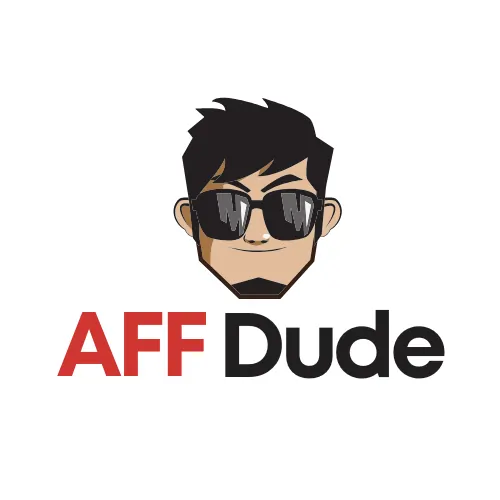

Why Non-Gaming Apps Need Specialized Ad Networks for Better Monetization?

Non-gaming apps behave very differently from games, so they need ad networks that understand longer sessions, utility-driven usage, and more varied user intents. Generic mobile networks often push aggressive formats or game-only campaigns that clash with productivity, finance, social, or education flows and hurt retention.

Specialized ad networks for non-gaming focus on brand, commerce, and service advertisers that feel natural inside these app categories.

They also usually offer better controls over frequency, placement, and category blocking, so you can protect your brand. By matching ad demand to non-gaming audiences and usage patterns, these networks deliver higher eCPMs without flooding users with irrelevant or disruptive ads.

Boost Your Non-Gaming App Revenue with These Ad Platforms

| Non-Gaming App Ad Network | Monetization Model | Platform Reach & Integration |

|---|---|---|

| AdMob | Hybrid (Bidding + Waterfall) | Global Android & iOS dominance; easy Google Play integration |

| Facebook Audience Network | Bidding Only | Massive social reach; leverages Meta user data for high relevance |

| InMobi | Bidding & Waterfall | Strong in APAC & emerging markets; excellent for brand demand |

| AppLovin | MAX Bidding | High-scale mediation platform with huge demand for utility apps |

| PubScale | Header Bidding / OpenWrap | Enterprise-grade wrapper connecting to premium brand SSPs |

| Smaato | Real-Time Bidding (RTB) | Publisher-centric platform with granular control over demand sources |

| SmartyAds | Programmatic / RTB | Full-stack programmatic solution for white-label & direct deals |

| Start.io | Data-Driven / SDK | Unique data insights for hyper-local targeting on Android/iOS |

| Mintegral | Programmatic / Bidding | Bridge to Chinese/APAC advertisers; strong global scale |

| PropellerAds | Direct / Performance | Focus on push, interstitial, and pop formats for high-volume traffic |

#1 AdMob

AdMob by Google remains the gold standard for non-gaming app monetization, offering unparalleled access to Google's massive advertiser ecosystem. The platform delivers consistent fill rates exceeding 95% across most geographies, making it the foundation of virtually every successful mobile monetization strategy for Ad Networks for Mobile App Developers Non-Gaming.

AdMob's machine learning algorithms automatically optimize ad placement and formats, analyzing thousands of variables in real-time to maximize revenue per user.

The platform's integration with Google Analytics provides developers with deep insights into user behaviour and ad performance, enabling data-driven optimization decisions that can increase revenue by 20-40% within the first quarter.

💡 Top Features: Mediation platform integration, Google Analytics sync, automated eCPM optimization, extensive ad format support.

2 Facebook Audience Network

Facebook Audience Network leverages Meta's unrivalled social data to deliver highly targeted ads that feel native to the user experience. For non-gaming apps focused on social interaction, communication, or content consumption, this network provides exceptional eCPM rates through its people-based targeting approach rather than device-based targeting for Ad Networks for Mobile App Developers Non-Gaming.

The platform's strength lies in its ability to match ads to users based on their actual interests and behaviors across the Meta ecosystem. This precision targeting typically results in 30-50% higher engagement rates compared to contextual advertising alone, translating directly into better monetization outcomes for developers.

💡 Top Features: People-based targeting, seamless Meta integration, native ad excellence, cross-platform campaign tracking.

3 InMobi

InMobi operates as one of the largest independent mobile advertising platforms, reaching 2 billion unique devices globally. The network has carved out a strong position in emerging markets, making it an excellent choice for developers with significant user bases in India, Southeast Asia, Latin America, and Africa for Ad Networks for Mobile App Developers Non-Gaming.

The platform's proprietary technology analyses over 20 billion data points daily to optimize ad delivery and pricing. This data-driven approach helps developers achieve eCPMs that are 5-10 times higher than standard banner ads, particularly for rich media and video formats that resonate well with non-gaming app audiences.

💡 Top Features: Appographic targeting capabilities, lookalike audience modeling, fraud detection systems, dedicated account management support.

4 AppLovin

AppLovin has evolved into a comprehensive growth and monetization platform specifically designed for app developers. The network's MAX mediation platform intelligently manages multiple demand sources, creating competition for every impression and consistently delivering industry-leading eCPMs for non-gaming applications across productivity, utility, and content verticals for Ad Networks for Mobile App Developers Non-Gaming.

The platform's machine learning algorithms predict which ad networks will generate the highest revenue for each specific impression, automatically adjusting in real-time based on performance data. This predictive bidding approach has helped developers increase their ad revenue by an average of 35-50% compared to static waterfall implementations.

💡 Top Features: MAX mediation excellence, predictive analytics engine, A/B testing infrastructure, unified auction capabilities.

5 PubScale

PubScale positions itself as a revenue acceleration partner for premium publishers and app developers with substantial scale. The platform combines ad mediation with hands-on optimization expertise, making it ideal for non-gaming apps that have reached product-market fit and are focused on maximizing monetization efficiency for Ad Networks for Mobile App Developers Non-Gaming.

PubScale's team of monetization experts actively manages campaigns, testing demand partners, optimizing floor prices, and implementing advanced header bidding strategies. This managed service approach consistently delivers 15-30% revenue lifts compared to self-managed solutions, particularly valuable for development teams focused on product innovation rather than ad operations.

💡 Top Features: Managed optimization services, premium demand partnerships, header bidding implementation, dedicated monetization strategist assignment.

6 Smaato

Smaato operates a global omnichannel marketplace designed to maximize attention and revenue across both mobile and connected TV environments. The platform's publisher-centric approach gives developers complete control over their monetization strategy while connecting them to hundreds of demand partners competing in real-time for Ad Networks for Mobile App Developers Non-Gaming.

The network's SPX platform integrates ad serving, mediation, and exchange functionality into a unified solution, simplifying the technical complexity typically associated with programmatic advertising. This consolidation reduces latency, improves fill rates, and provides clearer performance visibility for developers managing their monetization stack.

💡 Top Features: Omnichannel marketplace access, integrated ad server, brand safety controls, real-time performance analytics dashboard.

7 SmartyAds

SmartyAds delivers a comprehensive programmatic advertising ecosystem tailored for publishers seeking maximum control and transparency. The platform's white-label solutions and flexible integration options make it particularly attractive for developers building sophisticated monetization strategies across multiple non-gaming applications for Ad Networks for Mobile App Developers Non-Gaming.

The network's SSP (Supply-Side Platform) connects developers to over 50 DSPs (Demand-Side Platforms), creating intense competition for ad inventory that drives eCPMs upward. This programmatic approach consistently delivers fill rates above 90% while maintaining strict quality controls that protect user experience and app reputation.

💡 Top Features: Programmatic marketplace excellence, white-label customization options, blockchain transparency, anti-fraud detection systems.

8 Start.io

Start.io uses first-party data insights to deliver highly relevant ads to over 2 billion monthly users across 500,000+ integrated apps. The network's focus on audience intelligence makes it particularly effective for non-gaming apps with distinct user personas, enabling precision targeting that increases both engagement and revenue for Ad Networks for Mobile App Developers Non-Gaming.

The platform's MAIA (Mobile AI Audience) technology analyses user behaviour patterns to create sophisticated audience segments that advertisers value highly. This data-driven approach helps developers achieve premium eCPMs by proving their user base aligns with advertiser objectives, particularly for productivity, lifestyle, and utility applications.

💡 Top Features: First-party data monetization, AI-powered audience segmentation, flexible targeting parameters, detailed analytics reporting dashboard.

9 Mintegral

Mintegral specializes in interactive and engaging ad formats that drive exceptional performance for mobile app developers. While traditionally strong in gaming, the network has expanded its non-gaming capabilities with programmatic solutions designed specifically for utility, productivity, and lifestyle applications seeking to maximize user LTV for Ad Networks for Mobile App Developers Non-Gaming.

The platform's playable and interactive ad formats achieve engagement rates 3-5 times higher than static alternatives, making them particularly valuable for apps with younger demographics or those seeking to demonstrate premium features through advertising. This engagement translates directly into higher eCPMs and better overall monetization outcomes.

💡 Top Features: Interactive ad format innovation, programmatic optimization algorithms, Asia-Pacific market leadership, creative studio support services.

10 PropellerAds

PropellerAds brings performance-driven innovation to mobile app monetization with its multi-source advertising platform. The network's AI-powered CPA Goal bidding helps non-gaming developers maximize revenue while maintaining precise control over user experience.

The platform processes over 12 billion daily ad impressions through advanced algorithms that match inventory with the highest-paying advertisers in real-time. This massive scale combined with intelligent optimization consistently delivers competitive eCPMs across diverse geographies, from tier-1 markets to emerging economies.

💡 Top Features: AI-powered bidding automation, anti-fraud protection systems, self-serve platform simplicity, rapid campaign launch templates.

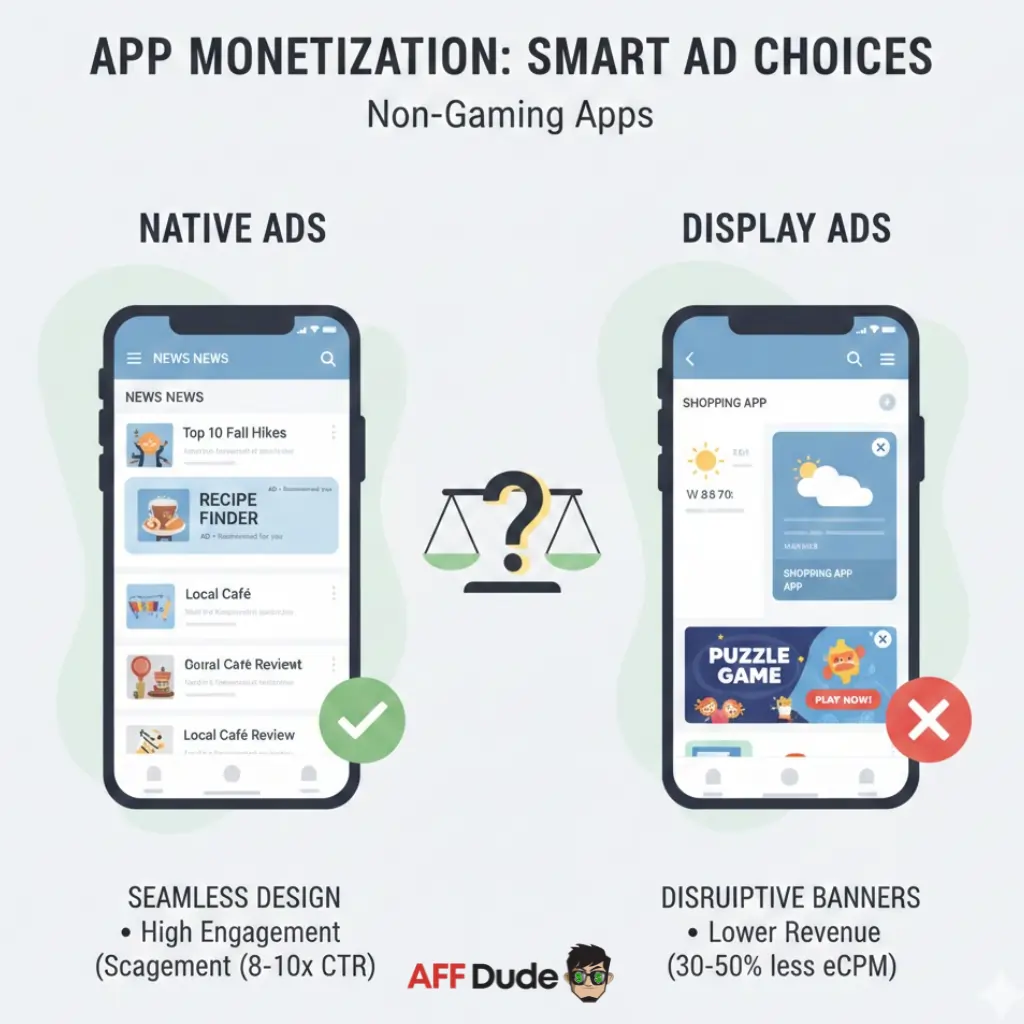

Understanding Ad Formats for Non-Gaming Apps: Native vs. Display

Choosing the right ad format can make or break your monetization strategy in non-gaming apps:

Native Ads

Display Ads (Banners/Interstitials)

Technical FAQ: Ad Networks for Non-Gaming Mobile Apps

How Do eCPM Rates Compare Between Gaming and Non-Gaming Apps?

Non-gaming apps typically achieve eCPMs ranging from $1-$15 depending on geography and user demographics, compared to gaming's $3-$25 range. However, non-gaming apps often capture revenue faster, with 90% realized within 30 days.

Which Ad Formats Perform Best for Non-Gaming Applications?

Native and rewarded video formats consistently deliver highest engagement and eCPMs for non-gaming apps. Banner ads provide steady baseline revenue while interstitials should be used sparingly at natural transition points.

How Ad Networks Impact App Performance and User Experience

Quality networks like AdMob and Facebook Audience Network use lightweight SDKs (<500KB) with minimal latency impact. Implementing ad refresh strategies and frequency capping maintains user experience while optimizing revenue generation.

What Fraud Prevention Measures Do Top Ad Networks Employ?

Leading networks implement multi-layer fraud detection including device fingerprinting, traffic pattern analysis, and machine learning algorithms. SmartyAds and PropellerAds specifically highlight blockchain-based transparency and advanced bot detection capabilities.

Monetizing Non-Gaming Mobile Apps Effectively

Most developers chain themselves to one ad network and watch their eCPMs tank. Smart publishers stack premium networks with mediation platforms to force demand sources into bidding wars for their inventory. Native ads and video formats from top-tier brands keep your UX clean while fill rates climb past 90%.

Single SDK setups leave thousands on the table monthly. Combine AdMob's reach with AppLovin's machine learning, then layer ironSource mediation to maximize what each impression actually pays. Your productivity or lifestyle app pulls different audiences than games—monetize accordingly or keep settling for scraps.

Recommended Articles