Are you ready to tap into one of the most profitable niches in affiliate marketing? The credit card industry is an evergreen goldmine, offering some of the best commissions available online. We've done the hard graft, reviewing countless financial affiliate offers to create the ultimate list of the best highest paying credit card affiliate programs for 2026.

Forget the guesswork. This guide provides the essential details on top-tier programs that can significantly boost your affiliate earnings. From premium travel cards to popular cashback offers, we'll show you exactly which programs deliver the biggest payouts and how to promote them for maximum profit.

What Are the Highest Paying Credit Card Affiliate Programs and Why Do They Matter?

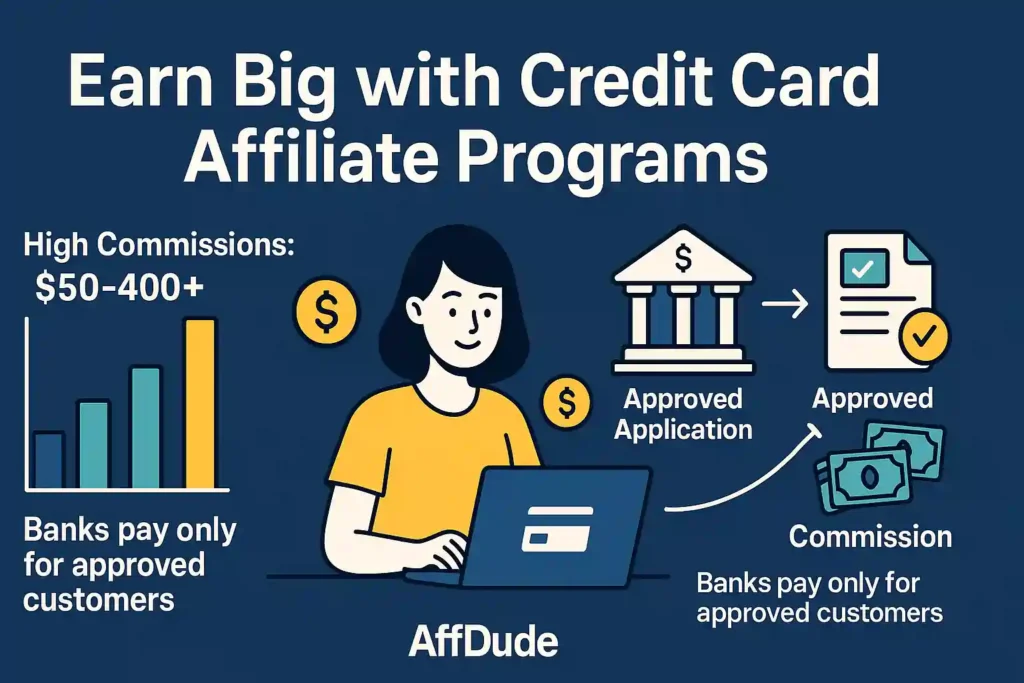

Highest-paying credit card affiliate programs are performance-based marketing partnerships that offer substantial financial compensation to publishers for driving successful customer applications.

These programs are characterized by high commission rates, often ranging from $50 to over $400 per approved credit card account, making them one of the most lucrative niches in affiliate marketing.

These programs are significant for several reasons. For affiliates and content creators, they represent a primary monetization strategy, allowing them to generate substantial revenue by leveraging their audience's interest in financial products.

For financial institutions, they are a highly efficient and scalable channel for customer acquisition, as they only pay for confirmed results, thereby maximizing their return on investment in marketing.

Maximize Affiliate Income with These Lucrative Credit Card Programs

| Affiliate Programs 💎 | Target Audience 🎯 | Best For 🌟 |

|---|---|---|

| American Express | Luxury Seekers | Premium Cards |

| Chase | Travel Enthusiasts | Sapphire Preferred |

| Capital One | Tech-Savvy Users | Flexible Rewards |

| CreditCards.com | Comparison Shoppers | Multiple Options |

| Experian | Credit Builders | Score Monitoring |

| Credit Karma | Financial Beginners | Free Services |

| Bankrate | Deal Hunters | Various Cards |

| Upgrade | Debt Consolidators | Low Interest |

| Luxury Card | High-Net-Worth | Exclusive Benefits |

| TransUnion | Credit Conscious | Credit Reports |

| Discover | Cashback Lovers | No Annual Fees |

| Amex Canada | Canadian Market | Local Benefits |

| Capital Bank | Credit Rebuilders | Secured Cards |

1. American Express

The American Express affiliate program is a cracking choice for marketers whose audience appreciates a bit of luxury. Amex is a massive name in finance, offering everything from travel rewards cards to premium charge cards. Promoting their products gives your content instant credibility.

You can target a wide range of customers, from savvy business owners to frequent flyers, by highlighting exclusive perks, global acceptance, and top-notch customer service. It's a solid brand to have in your affiliate arsenal.

Why Choose American Express?

Promote a globally trusted brand known for luxury rewards and appeal to high-end customers for potentially massive returns.

2. Chase

The Chase affiliate program is a brilliant opportunity, especially if your audience is looking for popular, user-friendly cards. They offer some of the most sought-after cards on the market, like the Chase Sapphire Preferred, which is a big draw for its travel rewards.

While it's more of a referral program for existing customers, it’s still a powerful way to monetise. You can earn a flat fee for every friend who gets approved, making it a simple and effective option for finance bloggers.

Why Choose Chase?

Leverage a well-known brand with popular cards that offer generous rewards, making conversions much easier for you.

3. Capital One

The Capital One affiliate program is another top contender, giving you access to a wide range of financial products to promote. Capital One is a technology-focused bank and a major player in the credit card space, which adds a lot of weight to your recommendations.

They are quite selective about their partners, looking for affiliates with high traffic and a reputation for fairness. If you make the cut, you'll be promoting a trusted brand known for flexible rewards and great service.

Why Choose Capital One?

Partner with a trusted, tech-savvy bank that offers a variety of cards, appealing to a broad audience.

4. CreditCards.com

CreditCards.com is an affiliate network in its own right, offering a massive portfolio of credit card offers from various issuers. This makes it a one-stop shop for affiliates who want to provide their audience with a wide range of choices.

You can compare different cards side-by-side, helping your readers find the perfect match for their needs, whether it's for balance transfers, rewards, or low interest rates. It’s a great way to diversify your offers without joining multiple programs.

Why Choose CreditCards.com?

Access a huge range of card offers from different banks, giving your audience plenty of choices.

5. Experian

The Experian affiliate program is a fantastic option if you're targeting small businesses or individuals keen on improving their credit scores. Experian is a big name in credit reporting, and its affiliate program lets you market premium credit reports and financial management tools.

Helping your audience get a better handle on their financial health can be a rewarding niche. The commission structure is quite attractive, offering a revenue share that can add up quickly.

Why Choose Experian?

Promote essential credit monitoring services from a leading brand and earn a high revenue share on sales.

6. Credit Karma

Credit Karma offers a unique angle by providing free credit scores and financial advice, which is a massive draw for users. Their affiliate program pays you for new user sign-ups, making it a cost-per-lead (CPL) model rather than cost-per-sale.

This can be easier to convert since your audience doesn't need to buy anything. You're promoting a genuinely useful tool that helps people manage their finances, which is an easy sell and builds trust with your readers.

Why Choose Credit Karma?

Earn money on free sign-ups, making it easier to convert while offering real value to your audience.

7. Bankrate

Bankrate is a heavyweight in the financial comparison space, and its affiliate program gives you access to a huge range of credit card offers. Much like CreditCards.com, it's an affiliate network that connects you with leading financial institutions.

This is ideal for affiliates who want to promote a variety of card types, from cashback to travel rewards. The commissions are competitive, making it one of the more lucrative choices out there for finance bloggers.

Why Choose Bankrate?

Access a massive network of financial products and earn high commissions by promoting a variety of card offers.

8. Upgrade

The Upgrade credit card brings something different to the table by combining the flexibility of a credit card with the lower interest rates of a personal loan. This unique selling point can be a powerful conversion tool.

It’s designed to help people pay off their balances faster, which is a major pain point for many credit card users. Their affiliate program offers a decent flat-rate commission for every approved applicant, making it a simple and profitable offer to promote.

Why Choose Upgrade?

Promote an innovative card with lower interest rates that helps customers pay off debt faster, a unique angle.

9. Luxury Card

If you want to go for the highest payouts in the game, the Luxury Card affiliate program is where it's at. This program targets high-net-worth individuals with a premium card that offers exclusive benefits like 24/7 concierge service and VIP airport lounge access.

The commission is an eye-watering $405 per sale, making it the highest-paying offer on this list. If your audience has expensive taste, this is the program for you.

Why Choose Luxury Card?

Earn the highest commission in the niche by targeting a premium audience with an exclusive, high-end product.

10. TransUnion

TransUnion is another major credit bureau, and its affiliate program allows you to offer your audience valuable credit monitoring services. By promoting TransUnion, you're helping people stay on top of their credit health, which is a crucial aspect of personal finance.

The program offers a flat fee for new sign-ups, providing a steady stream of income. It's a trusted brand, which makes it an easy recommendation for your audience.

Why Choose TransUnion?

Promote a trusted credit bureau and help your audience manage their credit with reliable monitoring services.

11. Discover

The Discover affiliate program is a great choice for affiliates targeting audiences interested in cashback rewards and no annual fees. Discover cards are known for their rotating cashback categories, which can be a strong selling point.

The program offers different commission rates for consumer and student cards, allowing you to tailor your promotions to specific demographics. It's a well-regarded brand with a solid reputation for customer satisfaction.

Why Choose Discover?

Attract a wide audience with popular cashback rewards and no annual fees, making for an easy promotion.

12. American Express Canada

For affiliates targeting a Canadian audience, the American Express Canada program is a must. It offers a range of cards tailored to the Canadian market, with commissions paid in Canadian dollars.

This allows you to create highly localised content that resonates with your readers north of the border. You can promote cards with travel rewards, cashback, and other perks designed for Canadian consumers, earning a handsome commission for each approval.

Why Choose American Express Canada?

Tap into the Canadian market with localised offers and earn high commissions in Canadian dollars for your referrals.

13. Capital Bank

Capital Bank offers a credit card designed for those with less-than-perfect credit, making it a valuable addition to your affiliate portfolio. The Open Sky Secured Visa Credit Card doesn't require a credit check, which opens it up to a large, underserved market.

The program allows email marketing, which is unusual in this niche, giving you more ways to reach your audience. While the commission is lower, the high potential for conversions makes it a worthwhile program.

Why Choose Capital Bank?

Target a large market of users with poor credit by promoting a card with no credit check required.

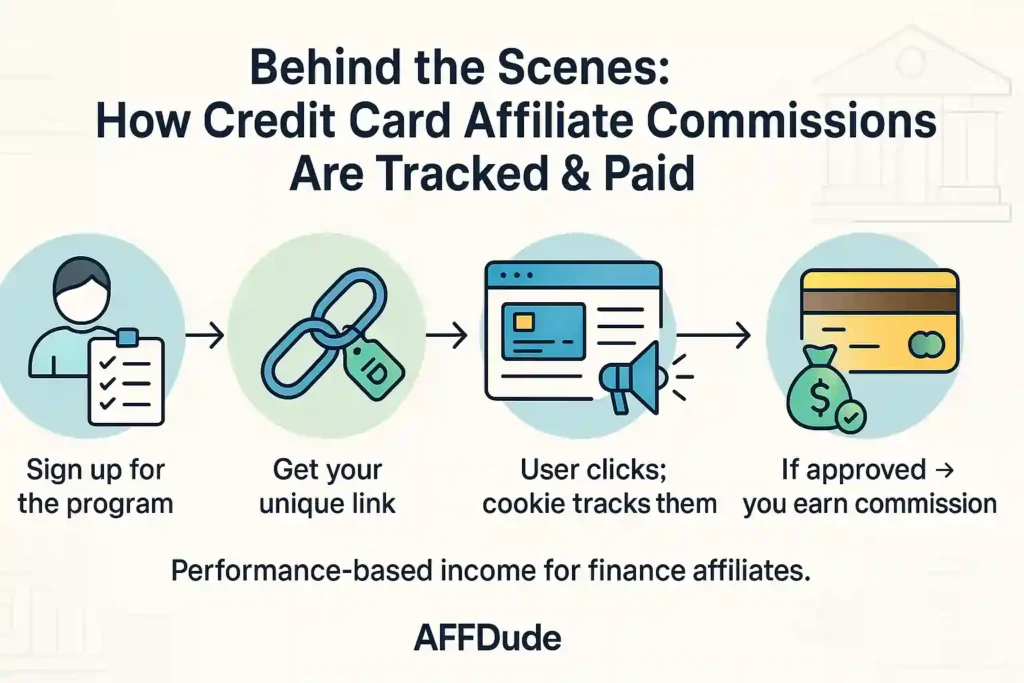

How Do the Best Highest Paying Credit Card Affiliate Programs Actually Work?

The operational framework of high-paying credit card affiliate programs is straightforward and data-centric, designed to track and reward performance accurately.

A Final Look at Credit Card Affiliate Programs

There you have it—a complete rundown of the best highest paying credit card affiliate programs for 2026. This niche offers some of the most lucrative payouts in affiliate marketing, with commissions reaching up to $405 per sale.

We've laid out the top options, from premium cards to those for building credit. Now the ball's in your court. Pick a program that suits your audience, create compelling content, and start driving conversions. Don't just read about it; get started and claim your piece of this profitable market today.

Recommended Articles