Scaling a utility app is rarely about getting the most downloads; it is about finding users who actually use your tool long-term. Many developers burn through budgets on generalist platforms that prioritize volume over intent, leaving them with high churn and wasted ad spend.

To solve this, you need acquisition channels that specialize in high-intent targeting and transparent performance data rather than just generic traffic.

This analysis evaluates the 12 Best CPI Ad Networks for Utility Apps and Software, focusing on platforms that deliver sustainable ROI. If you need advanced fraud protection or granular audience targeting, this guide helps you identify the right partner for your growth strategy.

What Defines the CPI Ad Networks for Utility Apps?

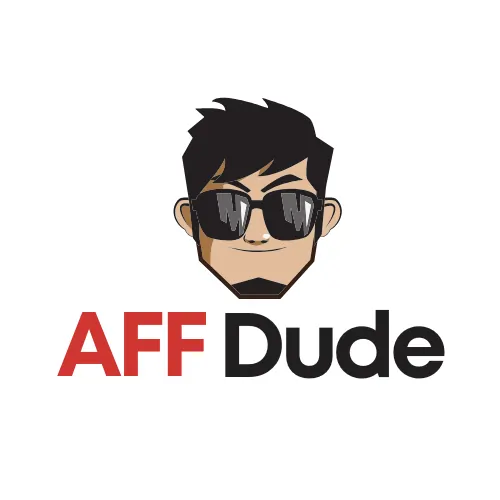

The right partner for your campaign goes beyond just finding the lowest cost per install. The best CPI ad networks for utility apps distinguish themselves by offering high-retention users rather than empty metrics.

For utility software, specifically like VPNs, cleaners, or antivirus tools the network must support advanced targeting that filters out accidental clicks. A quality network provides transparent sources, allowing you to block low-performing publishers instantly.

Key indicators of a top-tier network include:

Ultimately, the right platform ensures your budget fuels actual growth, setting the stage for the specific network recommendations below.

High-Performing CPI Ad Networks for Utility Apps

| Best CPI Ad Networks | Monthly Traffic Volume | Minimum Deposit |

|---|---|---|

| PropellerAds | 14B+ daily impressions | $100 |

| Adsterra | 11.8B pop impressions | $100 |

| RichAds | Custom performance traffic | $150 |

| AppLovin | 1.4B daily active users | Custom pricing |

| Digital Turbine | 375M monetized installs | Enterprise only |

| MyLead | 40K+ offers available | $0 |

| OGAds | Content locking specialists | $0 |

| AdMaven | 50B monthly impressions | $50 |

| Clickadu | 5.5B daily impressions | $100 |

| HilltopAds | Global tier traffic | $20 |

| LoopMe | Premium brand inventory | Custom pricing |

| Start.io | In app specialists | $500 |

1. PropellerAds

PropellerAds stands out as a premier multisource advertising platform that excels in delivering high-volume traffic for utility software and mobile apps. Their AI-powered CPA Goal algorithm automatically optimizes investment by targeting the most relevant audiences, ensuring efficient user acquisition for VPNs and system cleaners.

The platform offers distinct advantages for affiliate marketers seeking alternatives to traditional networks, providing exclusive direct offers and advanced anti-fraud protection. With massive daily impressions, it remains a top-tier choice for scaling utility campaigns globally without compromising on traffic quality or budget control.

PropellerAds Pros and Cons

Pros

Cons

Why Choose PropellerAds?

Ideal for performance marketers needing automated optimization tools to scale utility app campaigns efficiently and securely.

2. Adsterra

Coming in at #2 on our list, Adsterra is a powerful ad network best known for its innovative Social Bar format, delivering high conversion rates for utility apps and software downloads. It connects advertisers with quality traffic and supports flexible payment models like CPI and CPA, making it ideal for performance-driven campaigns.

This platform is particularly reliable for those exploring new monetisation avenues outside standard affiliate marketing platforms, boasting a 100% fill rate and dedicated partner care. Its Partner Care program ensures that both novice and experienced media buyers receive tailored support to maximise their campaign performance.

Adsterra Pros and Cons

Pros

Cons

Why Choose Adsterra?

Perfect for advertisers seeking creative ad formats and flexible payment models to drive high-converting utility installs.

3. RichAds

RichAds operates as a premium self-serve ad network, leveraging sophisticated AI technology to deliver top-tier traffic for antivirus and utility software offers. Their platform specialises in push, pop, and in-page push formats, allowing advertisers to reach engaged users with precision and scale effectively.

Marketers looking for reliable performance marketing channels will appreciate features like Micro Bidding and Target CPA, which provide granular control over campaign spend. By focusing on premium sources, RichAds ensures that utility app promotions reach legitimate audiences, reducing wasted spend on non-converting clicks.

RichAds Pros and Cons

Pros

Cons

Why Choose RichAds?

A strong choice for experienced media buyers demanding granular control and premium traffic for software campaigns.

4. AppLovin

AppLovin is a powerhouse in the mobile app ecosystem, offering an advanced user acquisition platform, AppDiscovery, that is highly effective for utility apps. Its sophisticated machine learning engines analyse vast amounts of data to connect advertisers with users most likely to install and engage with software.

While famous for gaming, its massive scale makes it a formidable tool for non-gaming apps seeking global growth through performance-based campaigns. The MAX mediation platform further enhances its capability, making it a comprehensive solution for developers aiming to dominate the competitive utility market.

AppLovin Pros and Cons

Pros

Cons

Why Choose AppLovin?

Best for developers with significant budgets seeking massive scale and AI-driven user acquisition for mobile apps.

5. Digital Turbine

Securing the #5 position on our list, Digital Turbine offers a powerful on-device value proposition that allows utility app developers to preload their software directly onto new smartphones. Its SingleTap technology removes install friction by enabling instant installs without app store redirects, resulting in significantly higher conversion rates.

This platform is an essential tool for those looking to diversify beyond standard web-based affiliate networks, providing direct carrier partnerships that build trust. It is ideal for major utility brands seeking to acquire loyal users right from the moment they unbox their device.

Digital Turbine Pros and Cons

Pros

Cons

Why Choose Digital Turbine?

The top choice for established brands wanting direct-to-device installs and high-retention users via carrier partnerships.

6. MyLead

MyLead is a comprehensive affiliate network that aggregates thousands of offers, making it a vital resource for marketers promoting utility apps and software. It provides a user-friendly interface with advanced tools like Content Lockers and Smartlinks to help affiliates monetise their traffic effectively.

Unlike typical traffic sources, this platform functions as a hub for finding high-paying CPI and CPA offers, serving as a reliable alternative to other marketplaces. Its reputation for timely payments and extensive training materials makes it a trusted partner for beginners and pros alike.

MyLead Pros and Cons

Pros

Cons

Why Choose MyLead?

Excellent for affiliate marketers looking for a vast catalogue of utility offers and reliable payment systems.

7. OGAds

OGAds is a specialised mobile performance network that excels in content locking and CPI offers specifically designed for mobile devices. It is a go-to platform for developers and marketers who want to monetise utility software and exclusive mobile content through high-converting incentives.

The network provides a seamless experience for those accustomed to performance marketing, offering weekly payments and exclusive tools to boost earnings. Its focus on mobile-first campaigns ensures that utility app offers are presented to the most relevant audience segments.

OGAds Pros and Cons

Pros

Cons

Why Choose OGAds?

Ideal for mobile-focused publishers needing specialised content locking tools and weekly payouts for their traffic.

8. AdMaven

AdMaven is a well-established advertising network that provides extensive reach for utility app campaigns through high-impact Popunder and Push notification ads. It offers a proprietary anti-AdBlock technology that helps advertisers reclaim lost impressions, ensuring maximum visibility for software offers.

For affiliate marketers, AdMaven serves as a direct traffic source that bypasses the limitations of saturated platforms, offering competitive CPM rates and a self-serve DSP. Its ability to deliver high volumes of traffic makes it suitable for scaling aggressive utility and antivirus campaigns.

AdMaven Pros and Cons

Pros

Cons

Why Choose AdMaven?

A solid option for advertisers needing high-volume traffic and technology to bypass ad blockers for visibility.

9. Clickadu

Clickadu is a premium ad network that supports multiple pricing models, including SmartCPA, making it highly effective for cost-conscious utility app campaigns. It offers a wide range of ad formats, such as video pre-rolls and skim, which are excellent for capturing user attention for software installs.

This platform is a strong contender for those seeking transparent traffic sources, providing advanced fraud detection to ensure clean user acquisition. Its focus on vertical-specific performance means it is well-tuned for VPN and utility software offers, delivering consistent results for media buyers.

Clickadu Pros and Cons

Pros

Cons

Why Choose Clickadu?

Great for cost-conscious marketers who want flexible pricing models like SmartCPA to control acquisition costs.

10. HilltopAds

HilltopAds is a smart self-serve advertising network that facilitates easy scaling for utility software campaigns through its intelligent traffic segmentation system. It offers advertisers a unique anti-adblocking solution that ensures their ads reach users who might otherwise be missed by standard networks.

HilltopAds is designed for reliability, offering net-7 payment terms and zero transaction fees for partners, which is a significant advantage over other networks. Its intuitive interface and real-time optimisation tools make it a practical choice for affiliates promoting utility apps.

HilltopAds Pros and Cons

Pros

Cons

Why Choose HilltopAds?

A reliable choice for advertisers valuing quick payments, adblock bypassing, and zero fees on transactions.

11. LoopMe

LoopMe utilises a sophisticated Intelligent Marketplace powered by AI to deliver superior brand performance and app user acquisition outcomes. By integrating with major exchanges and leveraging its acquisition of Chartboost, it offers unparalleled access to high-quality mobile inventory for utility apps.

This platform focuses on outcomes rather than just impressions, using its patented technology to optimise bids in real-time for maximum efficiency. It is a premium solution for app developers who need to scale their user base with high-retention users through programmatic channels.

LoopMe Pros and Cons

Pros

Cons

Why Choose LoopMe?

Best for established app publishers seeking premium, AI-optimised programmatic campaigns to drive high-quality user acquisition.

12. Start.io

Start.io is a leading mobile marketing and audience platform that leverages real-time data signals to drive efficient CPI campaigns for utility apps. Formerly known as StartApp, it provides direct access to over half a million active apps, allowing for precise targeting based on actual user behaviour.

Start.io's strength lies in its ability to build custom audiences, making it easier for advertisers to find users interested in system utilities and productivity tools. Its self-serve capabilities and transparent reporting provide the control needed to optimise ROI effectively.

Start.io Pros and Cons

Pros

Cons

Why Choose Start.io?

Perfect for mobile marketers who need precise audience targeting based on real-time user data signals.

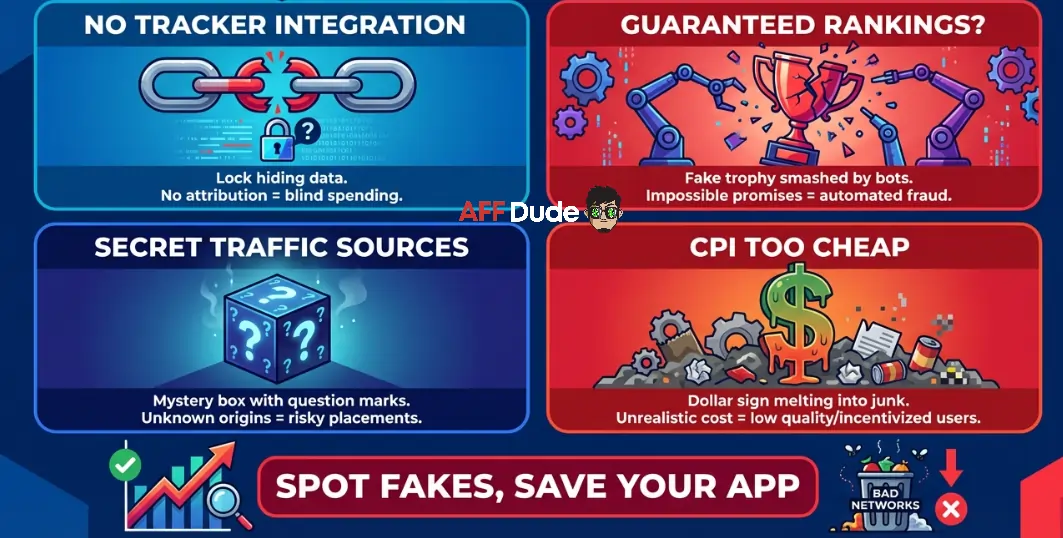

Red Flags to Avoid When Choosing CPI Ad Networks for Utility Apps

User acquisition can be risky, as promises of cheap installs often hide low-quality traffic that can harm your app’s reputation. In the utility app niche, where user trust is essential, working with unreliable ad networks can result in app store penalties or wasted budget on users who never even open the app.

Be wary of these critical warning signs before committing your budget:

Protecting your utility app means scrutinizing these details upfront to ensure every dollar spent contributes to genuine user growth.

Making the Right CPI Network Choice for Scalable Growth

Selecting the right CPI ad network is the difference between burning budget and scaling your utility app profitably. If you prioritize granular control, massive global reach, or unique device access, the platforms highlighted here offer proven pathways to quality user acquisition.

Success ultimately comes down to testing these trusted ad networks to find your specific audience match rather than relying on a single source. Drop a comment below if you have questions about optimizing your next campaign or need further recommendations.

Recommended Articles