Seeing your premium content interrupted by buffering ads or irrelevant fillers is a publisher's nightmare. It’s not just about lost revenue; it’s the frustration of risking the audience you worked so hard to build.

You need more than just promises of high CPMs—you need stability and genuine demand transparency to protect your brand. Finding the right partner shouldn't be a gamble.

We analyzed technical reliability, fill rates, and payment terms to compile this guide on the 7 top CTV and OTT ad networks for streaming publishers. If you run a FAST channel or a niche app, this comparison ensures you secure the revenue your content deserves.

CTV vs. OTT: Technical Differences in Ad Networks for Streaming Publishers

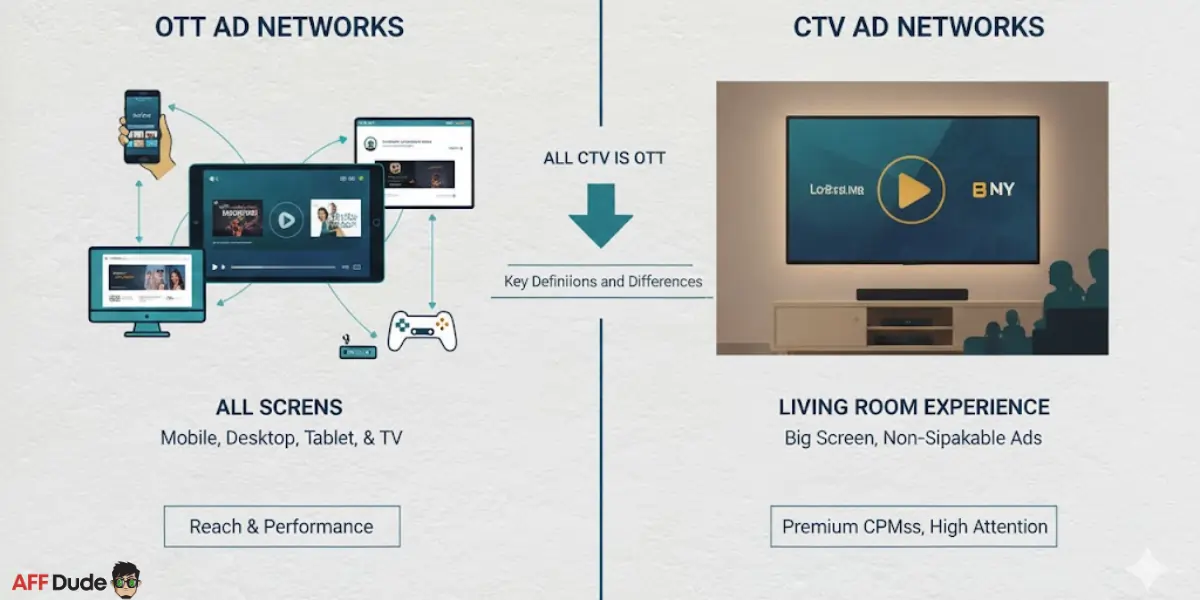

Distinguishing between OTT (Over-The-Top) and CTV (Connected TV) is critical for publishers configuring their ad waterfalls, as each demands distinct technical protocols. While these terms are often used interchangeably, they define different aspects of the delivery ecosystem that directly impact your monetization strategy.

OTT refers to the method of content delivery—video streamed over the internet rather than cable or satellite. This encompasses traffic across mobile, desktop, and tablets. CTV, however, specifically describes the device itself: a television set connected to the internet, such as a Roku, Smart TV, or gaming console.

For ad networks, this distinction dictates the inventory value and format:

Understanding this nuance ensures you implement the correct tags to maximize fill rates across all screens.

CTV and OTT Ad Networks for Streaming Publishers

| Best CTV & OTT Ad Networks | Primary Strength | Market Coverage |

|---|---|---|

| Magnite | Omnichannel reach 99% CTV supply | Global enterprise scale |

| FreeWheel | Direct publisher relationships | Premium video focused |

| PubMatic | AI yield optimisation | 70% top streamers |

| Google Ad Manager | Unified platform integration | Enterprise publishers |

| Seedtag | Contextual AI targeting | 11,000+ premium publishers |

| Adtelligent | Supply side independence | Programmatic buyers |

| Roku | First party streaming data | 43.8% US streaming |

1. Magnite

Magnite stands as the world’s largest independent sell-side advertising platform, offering streaming publishers a robust, transparent alternative to closed ecosystems. Their infrastructure is purpose-built for CTV and OTT, utilising advanced tools like ClearLine and Live Scheduler to streamline how media owners transact on premium video inventory while maximising yield.

Unlike basic monetization networks, Magnite provides direct control over your supply path, connecting you with top-tier global brands rather than low-quality arbitrage offers. Their integration of deep learning for real-time curation ensures that publishers can monetise live and on-demand content with the stability required for enterprise-level growth.

Why Choose Magnite?

Ideal for premium publishers seeking independent, transparent monetization with global scale and advanced live streaming tools.

2. FreeWheel

Coming at #2 on our list, FreeWheel offers a sophisticated Publisher Suite that creates direct connections between premium streaming video inventory and top-tier advertisers. By eliminating unnecessary middlemen, the platform allows media sellers to retain more working dollars while maintaining full control over their monetization strategy and ad delivery decisions.

The system simplifies programmatic video buying across every screen, making it easier for publishers to scale their OTT and CTV operations. This focus on transparency and contextual alignment helps media owners optimize their supply and improve the overall viewer experience.

Why Choose FreeWheel?

Best for established media owners wanting transparent, direct-to-brand relationships and robust programmatic control across premium streaming environments.

3. PubMatic

PubMatic offers a powerful, integrated platform designed to help streaming publishers maximize ad revenue through AI-powered yield optimization. Their infrastructure provides granular control over data monetization and access to premium demand, making it a robust alternative to closed ecosystems for those seeking transparency across the open internet.

With a focus on supply chain efficiency, PubMatic allows media owners to scale their CTV monetization effortlessly while maintaining brand integrity. Their tools enable real-time insights and curated audience connections, ensuring that every impression is valued correctly without technical complexity.

Why Choose PubMatic?

Ideal for publishers needing AI-driven yield management and transparent, high-scale demand to maximize fill rates globally.

4. Google Ad Manager 360

Google Ad Manager 360 is the industry-standard integrated platform for publishers needing enterprise-grade control over both direct and programmatic sales. By unifying inventory management for CTV, video, and display, it simplifies complex ad operations while protecting brand safety across every screen.

The platform’s robust infrastructure supports advanced audience segmentation and server-side ad insertion (DAI), ensuring seamless delivery for high-volume streaming environments. Its “Open Bidding” feature competes directly with header bidding to reduce latency and maximize yield without heavy technical lift.

Why Choose Google Ad Manager?

Best for high-volume publishers who need a single, powerful ecosystem to manage complex direct deals and programmatic demand simultaneously.

5. Seedtag

Seedtag is pioneering the future of contextual advertising with its proprietary AI, “Liz,” which leverages neuroscience to understand audience interest and emotion without relying on invasive cookies. By acquiring Beachfront, Seedtag has expanded its capabilities into the CTV space, offering streaming publishers a privacy-first way to monetise premium inventory through high-impact, contextually relevant ads.

Their neuro-contextual approach ensures that ads resonate with the viewer’s current mindset, driving significantly higher attention and brand recall compared to standard formats. This technology creates a safer, more effective ecosystem for publishers who want to protect user privacy while maximising revenue across video and connected TV environments.

Why Choose Seedtag?

Best for publishers prioritizing user privacy and brand safety, seeking high-engagement ads powered by advanced contextual AI rather than personal data.

6. Adtelligent

Adtelligent empowers streaming publishers with a holistic demand management stack that integrates ad serving, header bidding, and server-side ad insertion (SSAI) into one seamless platform. Their specialized “Ad Exchange” connects OTT and CTV inventory directly with global buyers, ensuring high-quality fill rates without the technical complexity of managing multiple vendors.

Designed for revenue growth and transparency, Adtelligent’s infrastructure supports advanced video stitching technology to deliver smooth, targeted ad experiences that bypass ad blockers. This makes it an essential tool for publishers looking to optimize yield while maintaining strict control over their demand pathways.

Why Choose Adtelligent?

Best for publishers needing a complete, transparent stack that unifies header bidding, ad serving, and SSAI to maximize video revenue.

7. Roku

Roku is more than just a device manufacturer; it operates one of the world's most powerful advertising platforms for streaming publishers, “America’s #1 TV streaming platform.” By publishing your channel or app on Roku, you gain direct access to a massive audience and their proprietary “Roku Advertising” network, which helps monetize content through premium video ads and brand sponsorships.

For content owners, Roku provides a unique ecosystem where discoverability and monetization go hand-in-hand. Their platform supports effortless scaling for free ad-supported TV (FAST) channels and on-demand apps, connecting your inventory with top-tier advertisers looking to reach engaged viewers on the big screen.

Why Choose Roku?

Best for content owners wanting immediate access to a massive, engaged audience and a built-in monetization infrastructure on the leading TV OS.

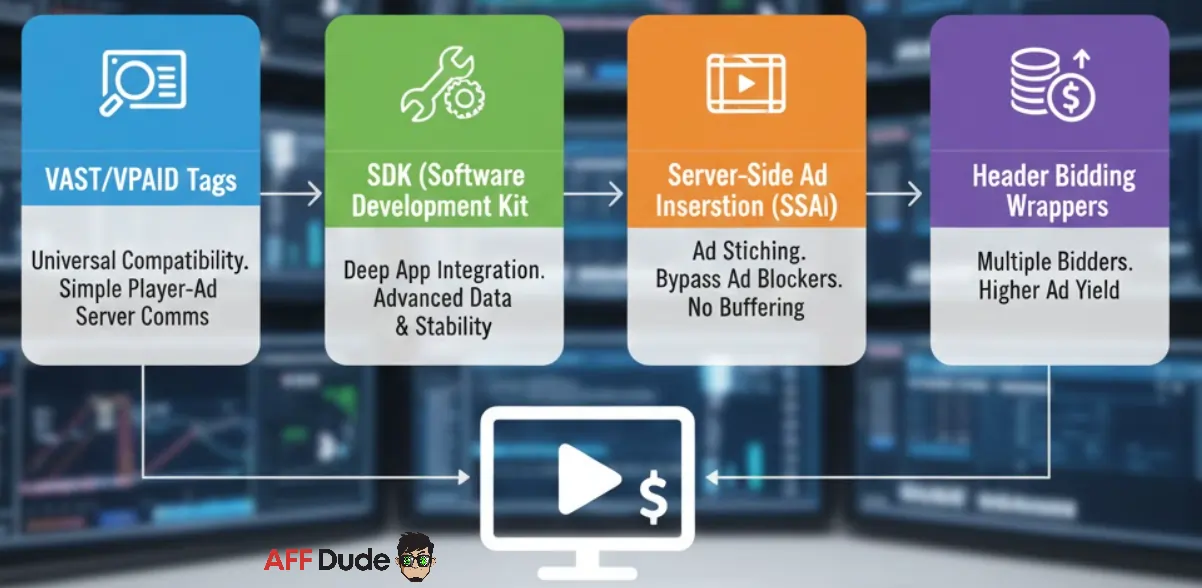

Setup & Integration for CTV and OTT Ad Networks

Seamless integration is the backbone of a profitable streaming business, as technical errors during setup can lead to significant revenue leakage and poor user experience. Choosing the right integration method depends heavily on your app architecture and the specific requirements of your demand partners.

Most premium ad networks support flexible integration options designed to minimize latency:

Selecting the correct protocol ensures your inventory is discoverable and that ads render correctly on every screen.

Wrapping Up

Selecting the right CTV and OTT ad network isn't just about chasing the highest CPMs; it's about building a sustainable monetization strategy that balances yield with a seamless viewer experience.

If you prioritize granular control, demand transparency, or advanced contextual precision, success lies in matching your technical infrastructure to your audience's behavior.

We encourage you to test different partners, analyze your fill rates, and secure the revenue your premium content truly deserves.

Recommended Articles