Struggling with the risks and admin headaches of traditional company cards? You're not alone. Physical cards open your business to fraud, and tracking team expenses often ends in surprise bills and wasted hours. This lack of control can lead to serious financial loss.

At Affdude, we've analysed dozens of virtual card providers to find a better way. We focused on key features like security and custom spending limits to find the best solutions.

This guide presents the top options to help you manage business payments with greater security and efficiency, cutting out the usual.

What is a Virtual Payment Card?

A virtual card is a digital payment instrument that exists solely in an electronic format, designed for secure online or ‘card-not-present‘ transactions.

At its core, a virtual card functions as a proxy for a primary funding source, such as a corporate credit line or bank account. It is comprised of a unique 16-digit card number, a CVV security code, and an expiration date, just like a physical card.

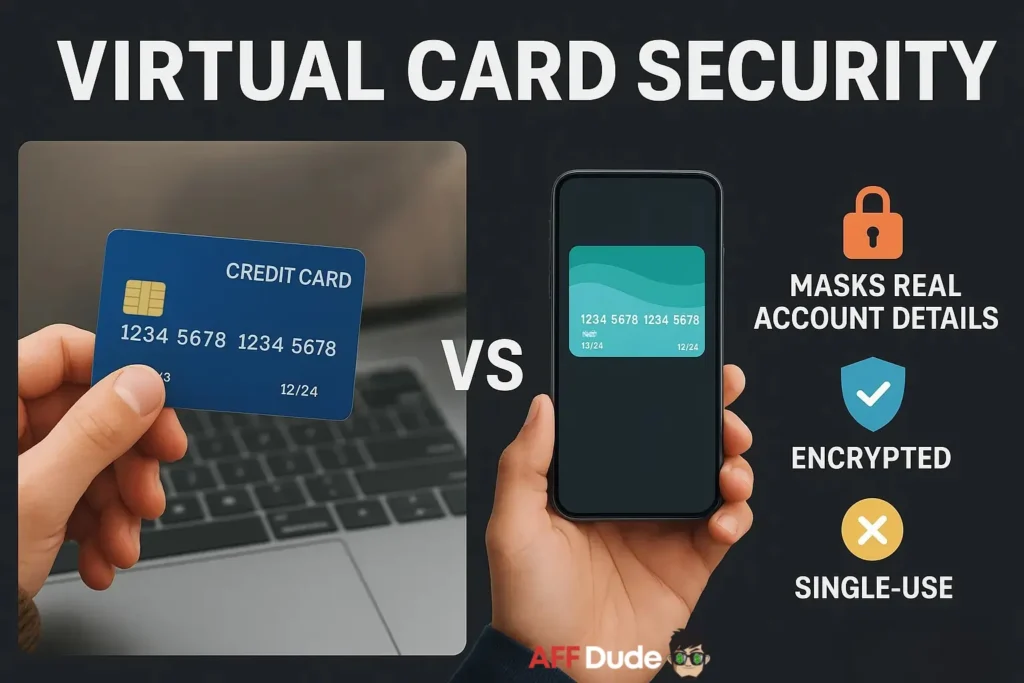

The fundamental technology behind a virtual card's security is its ability to mask the user's actual financial account details from the merchant.

When a transaction is initiated, only the disposable virtual card number is exposed, while the underlying account information remains confidential.

This process is fortified by encryption and secure payment gateways that protect data during transmission. Many virtual cards are generated for single-use, becoming invalid after one transaction, which renders them useless if compromised in a data breach.

Best Virtual Cards for Hassle-Free Online Spending

| Best Virtual Cards 🔥 | Setup Time ⚡ | Security Features 🛡️ |

|---|---|---|

| MyBrocard | 5 minutes | 3D Secure |

| Yescard | Card delivery | NFC protection |

| RedotPay | App download | Secure rails |

| Volet.com | Account verification | Multi-tier security |

| FlexCard | Telegram verify | 3D-Secure |

| Stellar Card | Invite only | Auto 3DS |

| AnyBill | Start free | Tier 1 BINs |

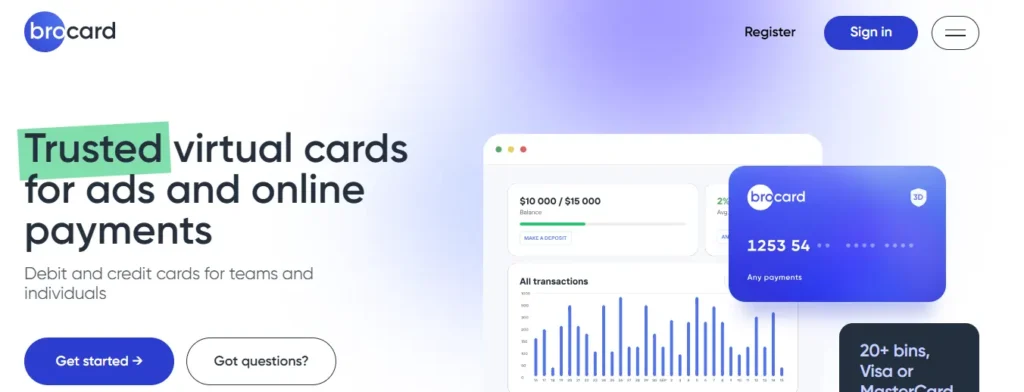

1. MyBrocard

MyBrocard provides a robust virtual card solution engineered for teams and individuals who require flexibility and control over their online payments. Its infrastructure is optimized for handling advertising spend on platforms like Google and TikTok, offering a wide array of BINs from different countries to ensure high success rates for transactions.

This platform empowers users with a streamlined workflow for managing multiple cards, budgets, and team member permissions.

With options for both USD and EURO currencies and multiple top-up methods, including cryptocurrency, it delivers a versatile financial tool for global business operations and affiliate marketing campaigns.

MyBrocard Key Functions

Limitations:

Primarily designed for business and advertising expenses; may not be suitable for general personal use or physical point-of-sale transactions.

Example Use Cases:

Security Features:

All issued virtual cards come with full 3D Secure support.

Set-up Process and Requirements:

Best For:

Media buying teams and affiliate marketers managing high-volume online payments.

Why Choose MyBrocard?

Choose MyBrocard for its unparalleled flexibility with diverse BINs, team management features, and fast card issuance for your advertising needs.

2. Yescard

Yescard offers a modern solution for professionals looking to network more effectively with NFC-enabled digital business cards. This service allows you to share your contact information, social media profiles, and company details with a simple tap of your card on a client's smartphone, creating a memorable first impression.

The platform is designed for complete customization, enabling you to align the card's design with your brand identity. Since it's a physical card with digital capabilities, it bridges the gap between traditional networking and modern technology without requiring clients to install any app.

Yescard Key Functions

Limitations:

This is a digital business card for sharing contact information, not a virtual payment card for financial transactions.

Example Use Cases:

Security Features:

Your contact information is shared securely via NFC tap technology.

Set-up Process and Requirements:

Best For:

Sales professionals, entrepreneurs, and marketers seeking an innovative networking tool.

Why Choose Yescard?

Choose Yescard to elevate your professional networking with a fully customizable, NFC-powered digital business card that makes sharing contact information seamless.

3. RedotPay

RedotPay bridges the gap between cryptocurrency and everyday finance, empowering users to spend stablecoins as easily as traditional money. Its platform offers both virtual and physical cards that are accepted by millions of merchants worldwide, making it ideal for online shopping, subscriptions, and daily expenses.

Designed for a global user base, RedotPay simplifies cross-border payments and financial management by integrating a multi-currency wallet with crypto services. It provides a seamless on-ramp for users to convert fiat to stablecoins and a secure off-ramp to spend digital assets in the real world.

RedotPay Key Functions

Limitations:

The platform's value is closely tied to the cryptocurrency market and evolving regulations, which can introduce risk and complexity.

Example Use Cases:

Security Features:

Every transaction is protected through secure, stablecoin-powered payment rails.

Set-up Process and Requirements:

Best For:

Crypto users seeking to spend stablecoins for everyday global payments.

Why Choose RedotPay?

Choose RedotPay to seamlessly connect your crypto holdings to the real world, enabling instant and secure payments anytime, anywhere.

4. Volet.com

Volet.com offers a comprehensive payment platform that integrates multi-currency accounts with both crypto and fiat capabilities. Its virtual and plastic cards are designed for global spending, allowing users to instantly access their account balance for online purchases, in-store payments via Google Pay or Apple Pay, and ATM withdrawals.

The platform is engineered for individuals and businesses requiring a versatile financial tool for mass payouts, affiliate payments, and P2P transfers. With support for over 150 countries and a user base of over 7 million, Volet.com provides a trusted e-wallet for managing digital money, exchanging assets, and spending funds worldwide.

Volet.com Key Functions

Limitations:

Card availability and specific features are region-dependent, and the service is not available to US citizens or residents.

Example Use Cases:

Security Features:

Your e-wallet is protected with regulated, multi-tier account security protocols.

Set-up Process and Requirements:

Create a free account online and complete the verification process. Once verified, you can order a virtual card for instant use or a plastic card for delivery.

Best For

Freelancers and online businesses managing payments across multiple currencies and crypto.

Why Choose Volet.com?

Choose Volet.com for its all-in-one platform that combines the flexibility of an e-wallet with the global spending power of virtual cards.

5. FlexCard

FlexCard is a virtual card service built specifically for the demands of affiliate marketing and media buying. It provides unlimited, non-personalized debit cards in USD and EUR, optimized for managing ad spend on major platforms like Google, Facebook, and TikTok.

The platform offers a wide selection of reliable BINs from key European and American regions, ensuring high transaction success rates. With transparent fees and robust team management features, FlexCard streamlines financial workflows for marketing teams and solo affiliates alike.

FlexCard Key Functions:

Limitations:

Account verification requires contacting support via Telegram, and the service is highly specialized for advertising spend, not general consumer use.

Example Use Cases:

Security Features:

Features 3D-Secure, with verification codes sent directly to your account.

Set-up Process and Requirements:

Quick, two-step registration without documents. Sign up online, then verify your account by contacting support on Telegram to get started instantly.

Best For:

Affiliate marketing teams and media buyers who require unlimited virtual cards.

Why Choose FlexCard?

Choose FlexCard for its specialization in affiliate marketing, offering reliable BINs, unlimited cards, and powerful team management features.

6. Stellar Card

Stellar Card is an exclusive, invite-only payment solution built for industry leaders in digital advertising and performance marketing. It provides a seamless platform to manage teams, issue unlimited virtual cards instantly, and control ad spend at scale. The service is optimized for speed and efficiency, featuring bulk actions and hotkeys.

Engineered as a core part of a business's financial infrastructure, Stellar Card offers private BINs, full-spectrum team controls, and built-in analytics. All cards draw from a single shared balance, eliminating the need for manual top-ups and simplifying budget management for large teams.

Stellar Card Key Functions

Limitations:

This is a private, invite-only service focused on high-volume advertising teams, making it inaccessible for smaller advertisers or general use.

Example Use Cases:

Security Features:

Features automatic 3DS for instant payment confirmation without requiring OTP codes.

Set-up Process and Requirements:

Access is granted through an invitation request. The platform focuses on established teams and businesses, ensuring a high-quality, low-risk user base.

Best For:

Large-scale media buying teams and digital marketing agencies running serious business.

Why Choose Stellar Card?

Choose Stellar Card for its expert-to-expert approach, providing a robust, scalable payment infrastructure designed to match the level of industry leaders.

7. AnyBill

AnyBill offers a trusted virtual card platform that excels in versatility, providing both debit and credit cards for teams and individuals. The service is expertly optimized for advertising platforms like Facebook and Google, ensuring a high card attachment rate for seamless campaign management.

It's also designed for general retail needs, with full support for Apple & Google Pay. The platform simplifies financial workflows with a single shared balance, eliminating the need to top up each card individually.

With unlimited card issuance and no hidden fees beyond a flat top-up commission, AnyBill provides a transparent and scalable solution for managing both ad spend and everyday online payments.

AnyBill Key Functions

Limitations:

The primary support channel is Telegram, which may not align with all corporate communication policies or preferences for integrated support.

Example Use Cases:

Security Features:

Utilizes constantly updated, trusted Tier 1 BINs for secure, seamless payments.

Set-up Process and Requirements:

Best For:

Users needing a versatile solution for both advertising spend and general online shopping.

Why Choose AnyBill?

Choose AnyBill for its expert ad platform support, flexible card options, and a simple single-balance system for all your spending.

Recommended Articles